Gold

Gold has captivated humanity for centuries, representing wealth, prestige, and enduring value. When it comes to investing in precious metals, gold bullion stands out as a timeless and reliable option. In this article, we will delve into the world of gold bullion as an investment, examining its historical significance, reasons for its appeal, and the different forms in which it can be acquired.

A Glittering History: Gold's allure dates back thousands of years, with civilizations throughout history recognizing its intrinsic value. From ancient Egypt to the Roman Empire and beyond, gold has been used as currency, a medium of exchange, and a symbol of power. Today, gold's investment potential continues to captivate investors worldwide.

What is Gold Bullion? Gold bullion refers to gold bars, coins, and rounds that are produced with high levels of purity. Bullion is valued based on its metal content, typically measured in troy ounces. Gold bullion offers investors the opportunity to own a tangible asset that represents a store of value.

Investment Appeal:

-

Safe Haven Asset: Gold bullion has long been considered a safe haven asset. During times of economic uncertainty, market volatility, or currency fluctuations, gold has historically retained its value or even appreciated. It provides a hedge against inflation and acts as a wealth preservation tool.

-

Diversification and Portfolio Stability: Including gold bullion in an investment portfolio helps diversify risk. Gold has shown a low correlation with other asset classes, such as stocks and bonds, making it an effective tool to balance portfolio volatility and enhance stability.

-

Store of Value: Gold has been a trusted store of value for centuries. Its limited supply, coupled with its universal acceptance and recognition, gives it an intrinsic worth. Gold bullion serves as a reliable asset that preserves purchasing power over the long term.

Types of Gold Bullion:

-

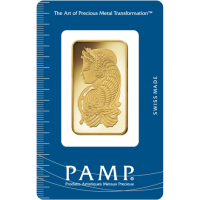

Gold Bars: Gold bars are available in various weights, ranging from a few grams to larger kilogram bars. These bars are produced by reputable mints and refineries, carrying their own unique designs, hallmarks, and certifications.

-

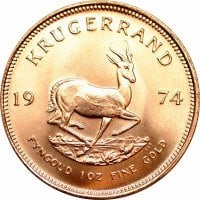

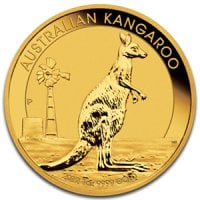

Gold Coins: Government-issued gold coins, such as the American Gold Eagle or South African Krugerrand, are popular among collectors and investors. These coins often have a legal tender value, but their intrinsic value is primarily based on their gold content.

-

Gold Rounds: Similar to coins, gold rounds are privately minted and do not hold legal tender status. They are typically produced in 1-ounce sizes and showcase various designs, offering investors an aesthetically pleasing option to acquire gold bullion.

Storage and Security: Given the value and desirability of gold bullion, proper storage and security are crucial. Many investors opt for secure storage facilities, safe deposit boxes, or private vaults to safeguard their holdings. Taking precautions, such as insuring the bullion and implementing security measures, ensures its protection and peace of mind.

Conclusion: Gold bullion offers investors a tangible and reliable investment opportunity that transcends time and economic fluctuations. Its historical significance, intrinsic value, and safe haven status make it an appealing choice for those seeking to diversify their portfolios, preserve wealth, and hedge against uncertainties. Whether in the form of bars, coins, or rounds, gold bullion represents a glittering asset that combines the allure of precious metals with the potential for long-term value appreciation. Embrace the golden opportunity and embark on your journey into the world of gold bullion today.

New Products For April - Gold

1 gram Gold Bar .999+ Fine Geiger Gold Bar From 25 x 1 Gramp Multicard Pack

12 X 1 Gram Divisible PAMP Suisse MULTIGRAM Gold Bar Fortuna .9999 Fine Gold

45th Anniversary - 5 gram Gold Bar - PAMP Suisse Lady Fortuna Veriscan

2.5 gram Gold Bar - PAMP Suisse Rosa Gold Bar .9999 Fine Gold - In Assay Card

Monthly Specials For April

2024 American Silver Eagle 1 oz & Pamp Suisse 1 gr 9999 Gold Bar

Save: 2% off